Save valuable time when underwriting with ResiModel

CREtech Blog

It’s been said by some that the commercial real estate industry is a very archaic business. There’s a lot of redundant work that’s done (when it comes to things like underwriting, for example) that can end up being relatively superfluous in the grand scheme of things. Elliot Vermes, founder and CEO at ResiModel, created the site after witnessing that a noticeable amount of work being done in the underwriting process for multi-family properties involved non-value add activities - such as data entry - and, alarmingly, that the people involved in the deals were spending up to 50 percent of their total time sorting, reformatting and inputting this data. Aside from remedying this issue, ResiModel seeks to help multi-family brokers win more sales and gain more exposure for their listings, while simultaneously assisting multi-family buyers in making smarter investment decisions and winning more bids. According to their website, ResiModel benefits the above parties in the following ways:

Brokers:

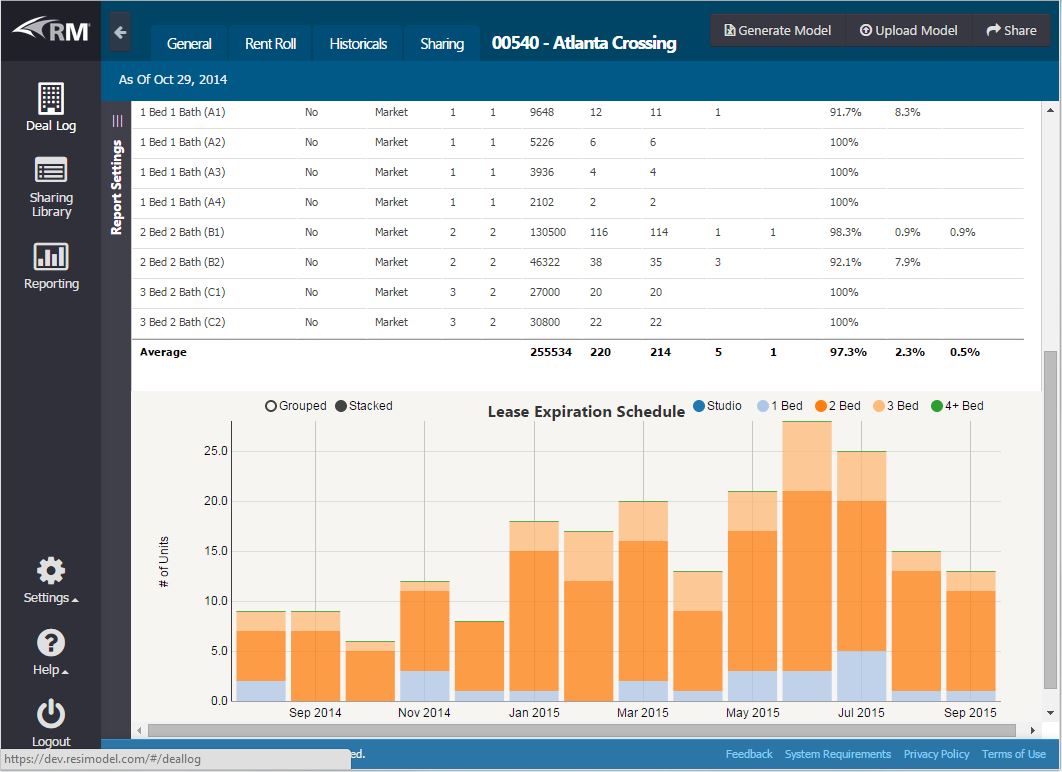

- Make the buyer’s job easier – Cut the buyer’s underwriting time by 50 percent by sharing property data in a standardized, electronic format

- Improve underwriting – Use ResiModel’s underwriting model to ensure consistent, accurate cash-flow projections firm-wide

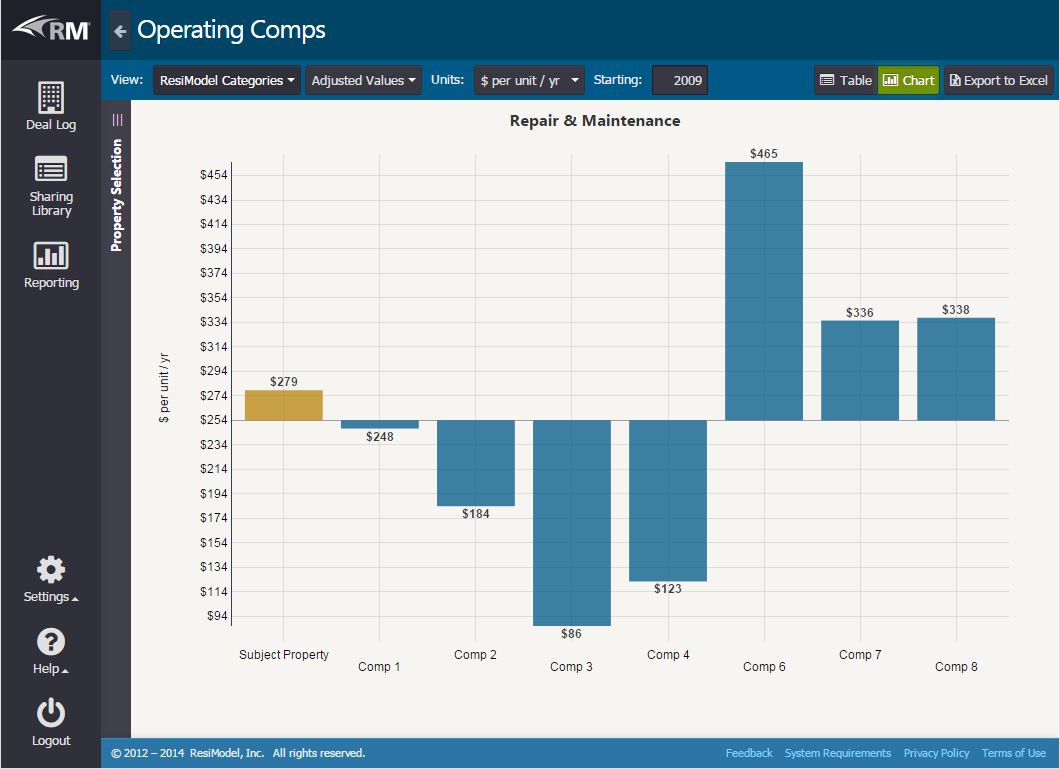

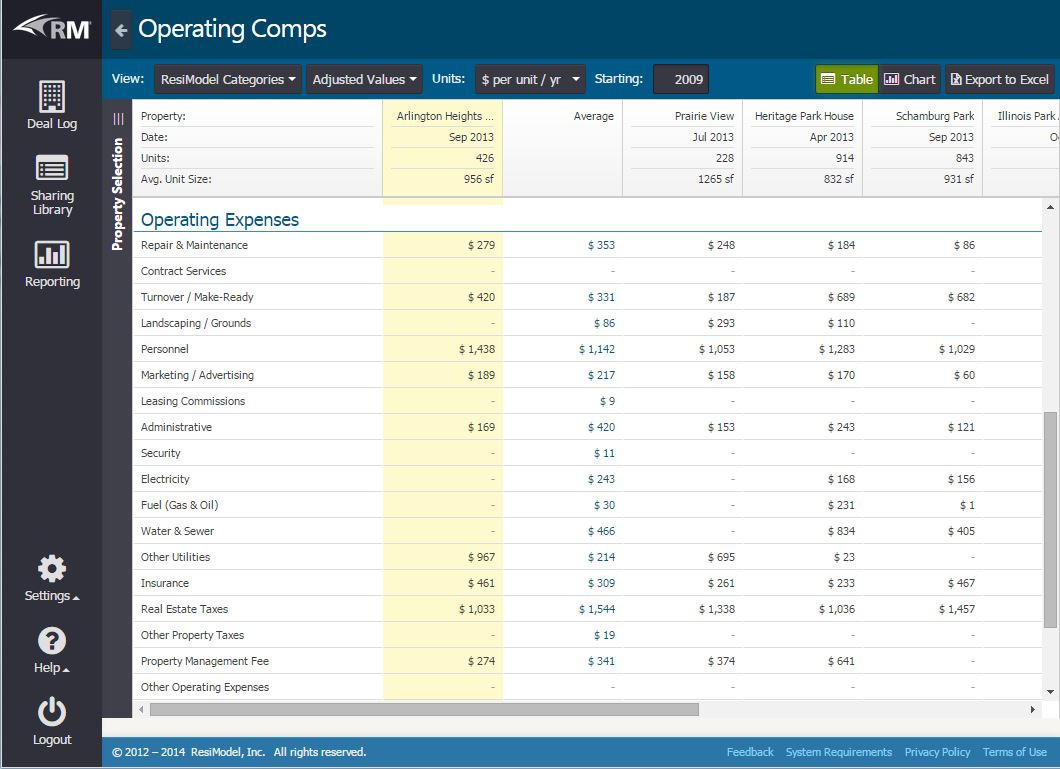

- Demonstrate market knowledge – Build your own database of operating comps and inform your clients about the best practices

- Justify higher NOI projections – Provide per unit costs from comparable properties to substantiate potential cost savings

- Quicker, more accurate underwriting – Spend your time improving the quality of your assumptions, rather than managing models

- Place more successful bids – Compare operating data across similar properties to identify upside potential

- Receive deals in a standardized format – Cut underwriting time by 50 percent, enabling you team to analyze and evaluate a greater number of deals

- Eliminate the risk of human error – Prevent errors from accidentally being introduced by automatically generating each model from scratch

Access to powerful rent roll analytics and the operating comps functionality is available at a cost of $1200 per year at a minimum of two users, and access to both the data and the model costs $3000 per year at a two-user minimum. (ResiModel also provides a data entry service on a complimentary basis for its clients.) Contact them and request a demo if you’re interested in learning more.

Access to powerful rent roll analytics and the operating comps functionality is available at a cost of $1200 per year at a minimum of two users, and access to both the data and the model costs $3000 per year at a two-user minimum. (ResiModel also provides a data entry service on a complimentary basis for its clients.) Contact them and request a demo if you’re interested in learning more.

In closing, be prepared to come away impressed if you try it because, with a model that took three years to develop, there’s certainly been a lot of thought put into ResiModel.

Interested in staying up to date with all of ResiModel’s latest news? Aside from checking this site for any updates with regards to new features, you can also follow their Company News Channel on The News Funnel.