News Archives | Page 97 of 1019 | CREtech

IKEA is to invest €3 billion, about $3.16 billion, in opening city-center stores and outfitting existing big-box locations to act as distribution hubs for online orders as the furniture giant looks to adapt to changing shopping habits.

In the last two years, BetaKit has reported on massive #CDNtech funding rounds leading to billion-dollar valuations. Here’s an interview with the Canadian VC who says those numbers are meaningless.

Airbnb CEO Brian Chesky recently announced that the company’s employees will be able to work from anywhere, including (for up to three months) overseas. He also abolished location -based pay, at least within the U.S. In the days following the announcement, Airbnb’s recruiting page received a million visitors. The company, which laid off a quarter of its staff during the pandemic, also released...

Companies throughout the U.S. are flooding the market with office space they want to sublease, aggravating landlords already facing weak demand as more tenants embrace hybrid work.

Flexible office space is coming back into the fold. After a rocky year leading up to the pandemic, flexible office space is once again spiking in popularity with the growing prevalence for remote and hybrid work, In short, it is becoming an important part of an office portfolio.

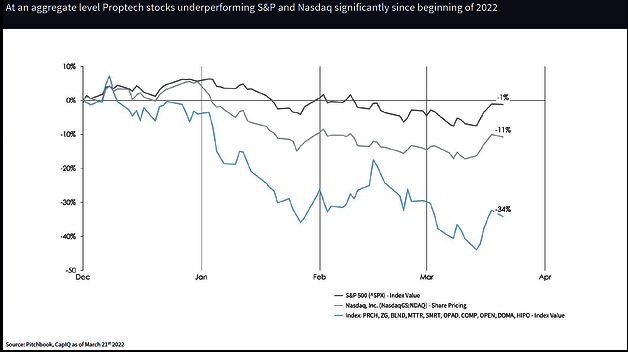

In April, First American Chief Innovation Officer Paul Hurst participated in a panel discussion at Inman Connect in New York, discussing the shifting capital environment for public and private proptech companies. Hurst offers some highlights from the panel discussion, discusses what the re-rating of proptech valuations means for the pace of real estate innovation in 2022, and shares insights from ...

Industrious, a provider of flexible workspaces that’s backed by CBRE Group Inc., acquired Great Room Offices and Welkin & Meraki to expand its footprint in Asia and Europe.

Route Konnect, a Cardiff-based AI software company, has picked up $1 million in a pre-seed equity investment round, which was led by the Development Bank of Wales’ Technology Seed Fund. also, additional investment came from proptech VC Pi Labs, early-stage investors SFC Capital and private angel investors with the backing of Plug and Play, the early investors in Dropbox and PayPal.

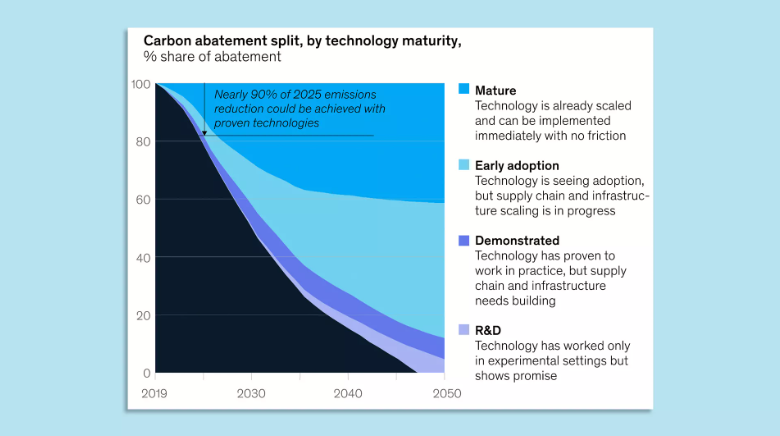

One thing that jumps out in McKinsey's look at a path to meeting U.S. climate targets is how much is feasible now with existing tech, Ben writes.

When tenants sign a lease, they trust the building’s management to maintain the property’s critical infrastructure. Electrical, heating, ventilation, water supply: these systems are mission-critical. Their failure can temporarily shut down a building, causing inconveniences and financial losses for occupying tenants. In some instances, the impact can be catastrophic.

Protecting such systems f...