Sets sights on future growth and new features

CHICAGO, Illinois, Jan. 3, 2018 -- Avail, an online rental platform, rang in the New Year by surpassing 100,000 landlord users, nearly doubling their user base from this time last year. As user growth accelerates, Avail is setting its sights on aggressive signup goals in the next 18 months, while planning ne...News Archives | Page 866 of 1020 | CREtech

SEATTLE—The sheer size of the vacation rental market has triggered meteoric growth and innovation across the entry/exit management systems space as US revenue was projected to exceed 13 billion in 2018. As vacation rental demands increase, the number of business and individuals transforming additional owned properties into all-year vacation rental properties will increase correspondingly.

A lot of people will say that traditional retail is dying. They’ll point to the rising prominence of e-commerce, which accounts for less than 10 percent of total retail in the U.S. and a whopping 15 percent or more of total retail in China, as diminishing opportunities for traditional retail. But the reality is that, thanks to technology, the future of traditional retail has never been brighter.

Ahead of speaking at PSFK's Future of Retail 2019 Conference on January 16, Fifth Wall partner Natalie Bruss shares insight from the firm's unique vantage point as the connective tissue between real estate companies and digitally native vertical brands

This time of year marks a familiar tradition here at the Review, one that’s spent compiling a list. It’s not just any list, (in our eyes at least, but hopefully our readers agree). Rather, it’s an attempt to tie a bow on the past year by assembling a time-capsule-like toolkit, full of the best tactical wisdom that seasoned company builders had to offer in the last year. To that end, we parse...

It’s common to associate the term “big data” with targeted advertising and invasions of privacy, but for New York City-based commercial real estate management company Rudin, the massive sets of numbers can help save the world.

In response to requests from utility companies and government entities to reduce emissions and prevent catastrophes like the northeast blackout in the summer of 200...

As we start 2019, the PropTech industry is likely to continue experiencing extraordinary growth. To better provide you with updates and the latest trends in this space, Goodwin is introducing PropTech Pulse, a short series of articles from members of our PropTech practice.

Over the coming year we expect to see an expansion in smart building technologies and tenant experience applications, the I...

WeWork has received yet another multibillion-dollar investment from SoftBank, and while the number may be smaller than the company's CEO hoped, it is enough to kick-start a new era for the company.

On Tuesday, the coworking giant announced the closure of a $6B investment from SoftBank, $4B of which had previously been disclosed. The new $2B is a far cry from the $16B deal that would have seen t...

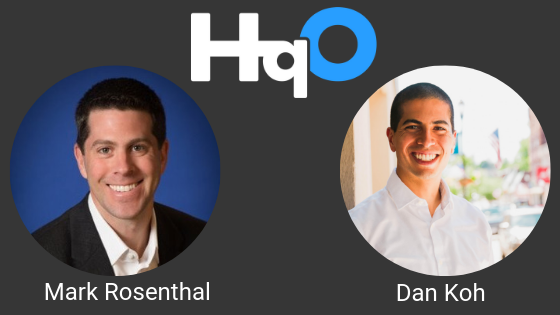

Tuesday, January 8, 2019 - HqO, a tenant experience (TeX) platform for commercial real estate, today announced the addition of two new executive hires: Mark Rosenthal as VP of marketing, sales & success, and Daniel Koh as partner. Both executives bring a unique skill-set with roots in technology, real estate, sales, government, and business operations, as well as a deep understanding of the functi...

Birmingham, Ala.- Retail Strategies, LLC, a retail municipal consulting firm, has exclusively partnered with Space Jam Data of New York. The collaboration of the two companies is expecting to help communities attract and gain new retail with the help of Facebook surveys.

Space Jam crowdsources local consumer opinions to help local leaders and retail real estate professionals understand what pe...