News Archives | Page 134 of 1033 | CREtech

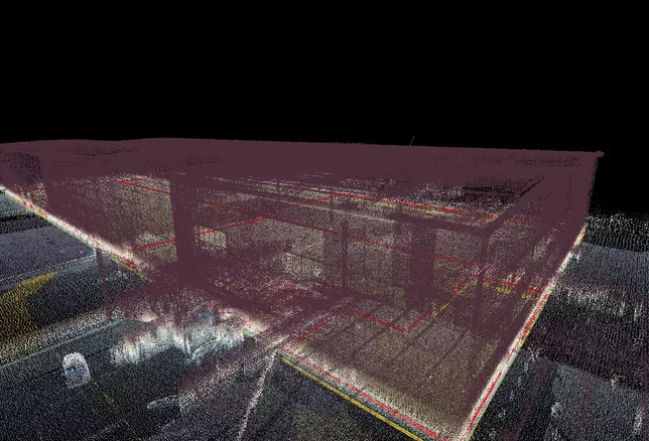

With the construction industry already bogged down due to pandemic-related schedule delays and labor shortages, contractors don’t want to be further slowed down by avoidable errors. In 2021, rework accounted for 30% of the work on a typical construction project. Much of that has been due to mistakes arising from avoidable gaps between plans and fieldwork.

A proptech firm that claims to have produced the first “check engine light” for the home launched its service with more than $12 million in seed funding.

Global venture funding reached $160 billion in the first quarter of 2022, Crunchbase data shows, marking the first time in a year of records when startup capital fell quarter over quarter.

Is this what the latest class of alternative property assets looks like? What are believed to be the world’s first nonfungible tokens, or NFTs, of digitised commercial real estate have just changed hands.

GI Partners’ the Real Estate Essential Tech + Science Fund has drawn great interest from investors wanting in on data center properties, life sciences buildings, and “always on” research & development facilities within the office and industrial sectors.

HqO, the industry-leading tenant and workplace experience platform, today announced a strategic partnership with Related Companies, the most prominent privately-owned real estate firm in the U.S., to power Related’s tenant experience (TeX) technology across its commercial and luxury residential portfolio. Elements of the best-in-class technology Related developed to serve its Fortune 500 tenants...

Witco, a leading provider of digital workplace experience solutions, has ramped up its European expansion, opening an office in Munich and making C-Suite hires in the UK and Germany.

Latch CFO Garth Mitchell is leaving the company less than a year after he assumed the role and led the company’s public market debut through a special purpose acquisition vehicle, or SPAC, an accidental e-mail obtained by TechCrunch shows. The executive shakeup is still not showcased on the news portion of Latch’s website, but the company did file with the SEC, as well as release the news via ...