Dozens of retailers, some of them the lifeblood of America's shopping malls, have been pushed to the brink and filed for bankruptcy during the coronavirus pandemic. Apparel brands like J.Crew, Brooks Brothers and New York & Co. parent company RTW Retailwinds. Department store chains Neiman Marcus, J.C. Penney and Stage Stores. The health chain GNC. The kitchen supp...

Lauren, Author at CREtech | Page 217 of 287

The effects of COVID-19 are far-reaching for all industries, and the commercial real estate sector is no outlier. All asset classes have had to deal with the ebbs and flows of tenant responses to this environment - at the forefront payment defaults, store closures, and lease terminations. Naturally, vacancy and delinquency rates have spiked, putting pressure on owners and operators of commercial s...

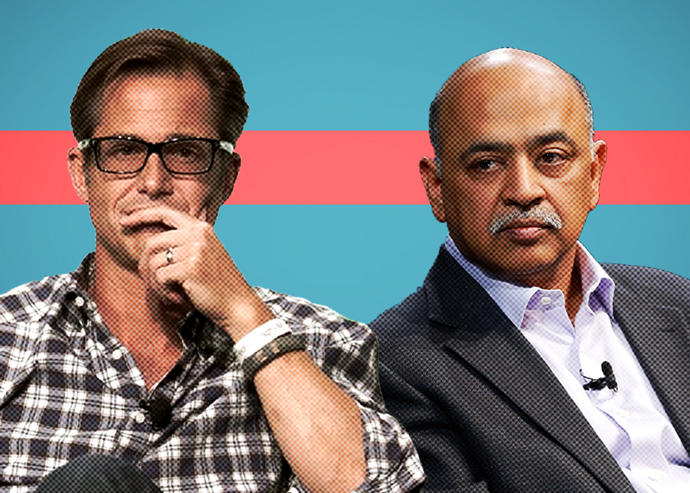

Last August, R.J. Pittman hopped on stage at a Las Vegas conference to promote his company. A seasoned tech executive with stints at Apple, Google and eBay, Pittman was less than a year into his role as CEO of Matterport, which develops and sells cameras and software to create 3D digital models of interior space.

LinkedIn will cut about 960 jobs, or around 6% of its workforce, as the Microsoft Corp. MSFT 0.61% -owned professional networking ...

Microsoft Corp. said the first investment for its $1 billion climate fund will be in venture capital firm Energy Impact Partners. The software maker also joined with Nike Inc., Starbucks Corp., Unilever NV and Danone SA in a new consortium devoted to sharing resources and tactics for slashing carbon emissions, bringing together the efforts...

In this episode The Propcast talks to Naqash and Imran about how they together founded REIM Tech Association, and about good proptech's in the market across the world, what technology is missing, and what makes a good pitch to the real estate world.

The coronavirus pandemic is accelerating a move by consumers toward online financial services and demonstrating that banks can operate with fewer physical branches, a Goldman Sachs Group Inc. executive said.