brandonlin, Author at CREtech | Page 29 of 165

Esusu, a startup at the intersection of fintech and proptech, raised $130 million in Series B funding from SoftBank and others at a $1 billion valuation.

The New York-based company, one of the few Black-owned startups to achieve unicorn status, aims to help renters get recognized by credit bureaus for making timely rent payments, a benefit that mortgage payers have long enjoyed.

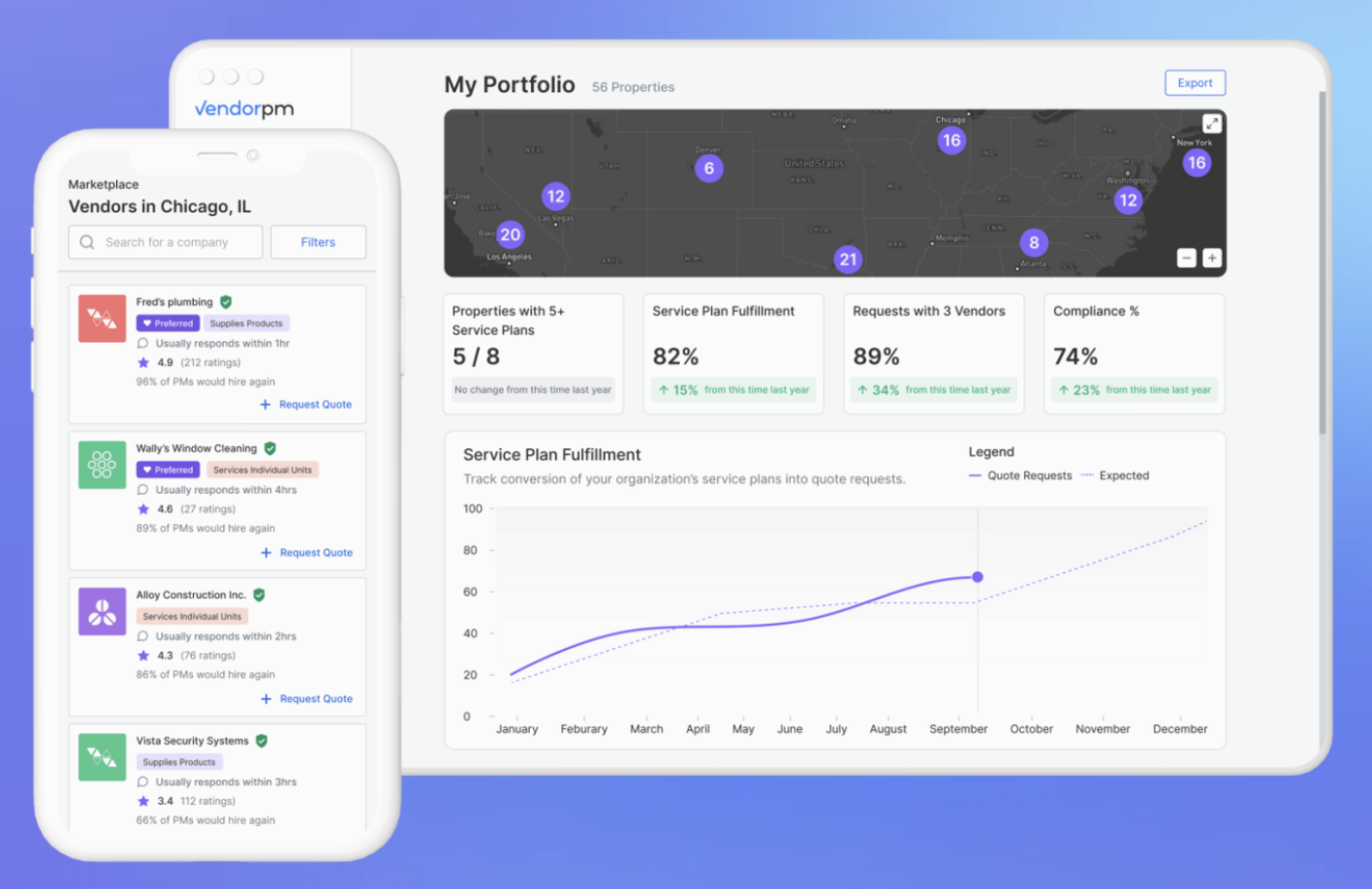

VendorPM, a Toronto-based marketplace that connects property managers with reputable vendors, has raised $6 million in seed funding led by Bessemer Venture Partners. The software-enabled marketplace aims to modernize the way property managers manage, source and procure service vendors. The startup currently manages a two-sided marketplace across Canada in suppor...

Simon Davis of Impec Group explores the transformation of corporate real estate, and the variety of new roles technology will play going forward.

Start your free 30-day trial to get full access videos like this.

SiteAware, a Hoston, TX-based Digital Construction Verification (DCV) technology, raised $15m in Series B funding round.

The round was led by Vertex Ventures Israel, with participation from existing investors Robert Bosch Venture Capital GmbH, Axon Ventures, Oryzn Capital, The Flying Object, and ...

2150 today announces a series of new appointments as part of a renewed approach to measuring the overall impact of its €270m fund and the companies in which it invests.

Peter Hirsch has joined 2150 as Head of Sustainability. A key part of his role is to lead its impact investment due diligence and to expand the 2150...

If you’ve ever taken out a mortgage, you know how painful and tedious the process can be.

In an effort to make it simpler, faster and cheaper, a pair of former Blend employees have teamed up to build mortgage loan origination software that will connect banks, credit unions, mortgage bankers and brokers. Or in other words, they want to make it easier for financial i...

Despite Zillow’s iBuying fiasco, other companies are still pursuing the strategy, each with its own approach. For investing platform Roofstock, that means focusing on buying single-family homes with tenants in place — an unconventional approach.

The past few years have been a case study in finding creative solutions for unpredictable situations. The spread of the COVID-19 pandemic has impacted global market conditions for every industry segment. Because of the fundamental need for shelter, employment, manufacturing and storage, the real estate industry has been at the forefront of these changes. The limitations of the pandemic have forced...